California has been at the forefront of addressing housing shortages through innovative legislation. Two key laws, SB-9 and AB-1033, have significantly impacted homeowners’ options for developing their properties and potentially increasing their value. Let’s explore these regulations and their implications for California homeowners.

Senate Bill 9 (SB-9)

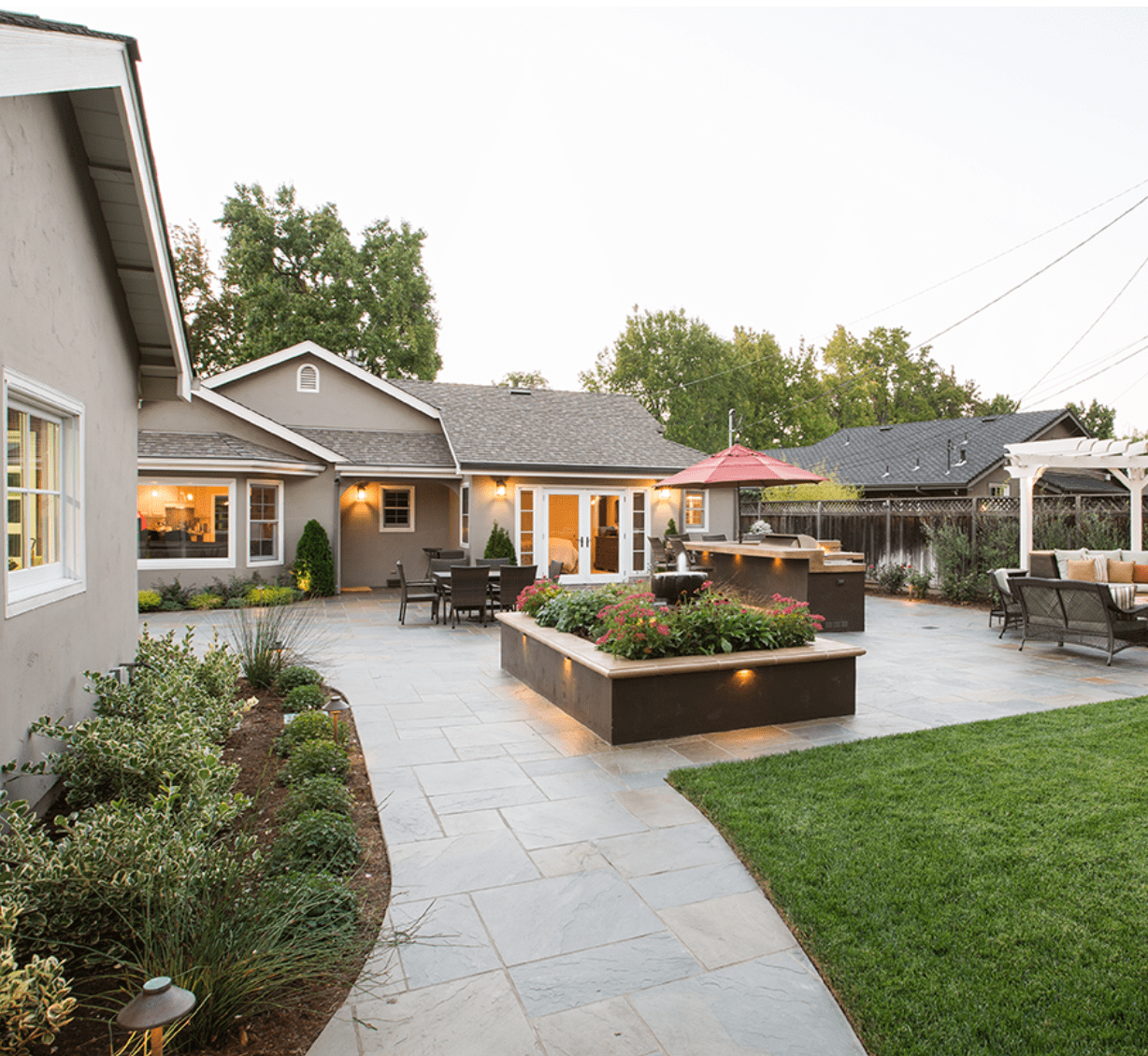

SB-9 is a game-changer for single-family homeowners. This law allows property owners to split their residential lots into two parcels and develop up to two units on each parcel. This means you could potentially have four units on what was originally a single-family lot. The flexibility in unit types is impressive – you can opt for a single-family residence (SFR), an SFR with an ADU, or a duplex on each parcel.

One of the most attractive aspects of SB-9 is the potential for larger units. While municipalities must allow at least 800 square feet per unit, many permit even larger sizes, limited only by lot dimensions and setback requirements. This flexibility can lead to significant property value increases and create opportunities for rental income or multi-generational living arrangements.

SB-9 is a statewide mandate, ensuring consistent implementation across California. However, it’s worth noting that the process can be costly, with fees and expenses for lot subdivision ranging from $50,000 to $75,000 before any construction begins.

Assembly Bill 1033 (AB-1033)

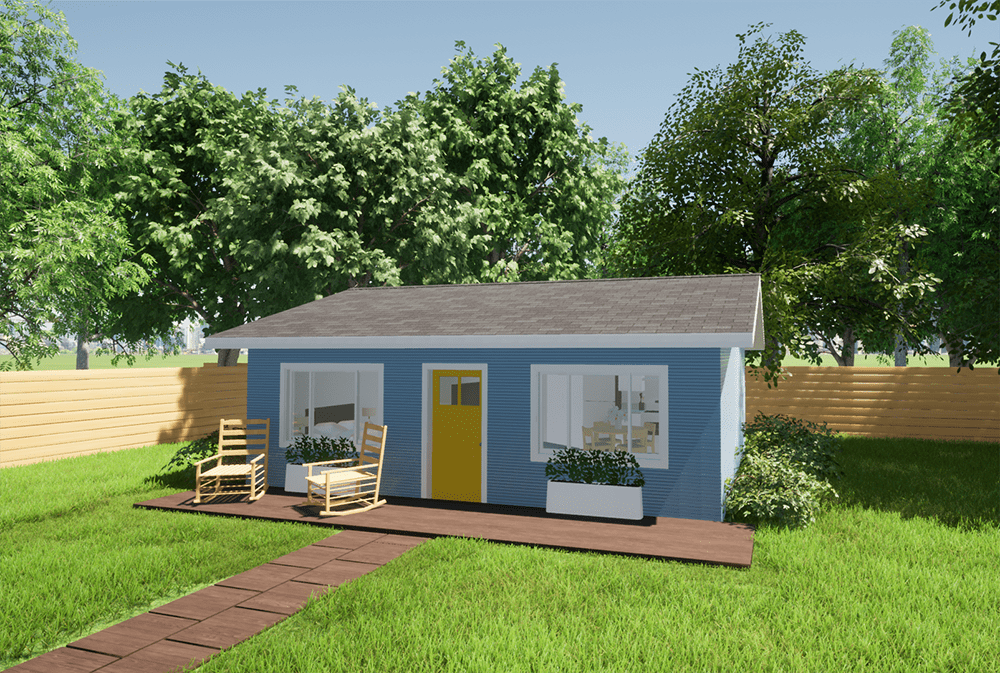

AB-1033 takes a different approach to ADU development. This law allows homeowners to convert existing ADUs into separate, sellable homes by creating a homeowners’ association that treats ADUs as townhomes or condos sharing utilities and common areas.

While AB-1033 offers exciting possibilities, it’s important to understand its limitations. Unlike SB-9, AB-1033 is not a statewide mandate and only applies in cities that choose to implement it. San Jose is currently pioneering this approach, with other cities expected to follow suit.

AB-1033 can be particularly beneficial for homeowners who already have ADUs on their property. It provides a pathway to sell these units separately, potentially unlocking significant value. However, the process can be more expensive than SB-9, involving not only lot subdivision costs but also legal fees for creating and maintaining a homeowners’ association.

Comparing SB-9 and AB-1033

When deciding between these options, consider the following:

1. Number of Units: SB-9 allows for up to four units, while AB-1033 typically permits up to three (one SFR, one ADU, and one Junior ADU).

2. Unit Size: SB-9 offers more flexibility, potentially allowing units over 2,000 square feet, while AB-1033 caps ADUs at 1,200 square feet and JADUs at 500 square feet.

3. Property Value: SB-9 developments retain single-family home status, which typically commands higher values than the condominium designations under AB-1033.

4. Existing ADUs: If you already have an ADU, AB-1033 might be more advantageous as it provides a direct path to selling that unit.

5. Zoning Flexibility: While SB-9 only applies to single-family zoned lots, AB-1033 may offer more flexibility depending on local implementation.

Making the Right Choice

For homeowners considering ADU development, it’s crucial to assess your specific situation. If you don’t currently have an ADU, SB-9 might offer more immediate benefits and flexibility. However, if you already have an ADU and are looking to unlock its value, AB-1033 could be the better option.

Remember, these processes can be complex and costly. It’s advisable to consult with local experts who can guide you through the intricacies of lot splits, ADU development, and local regulations. Next Stage works with outside partners that specialize in navigating these processes, offering comprehensive services from initial assessment, through planning to final approval.

As California continues to evolve its housing policies, homeowners have unprecedented opportunities to maximize their property’s potential. By understanding these regulations and carefully considering your options, you can make informed decisions that align with your long-term property goals and contribute to addressing California’s housing needs.